Are you a business owner struggling to understand credit card interchange rates?

You're not alone. Interchange rates can be a bit confusing, but they are a crucial component of accepting credit card payments. In this blog post, we will break down what credit card interchange rates are and how they work, so you can make informed decisions for your business.

First and foremost, it is essential to work with someone who is knowledgeable about credit card interchange rates. These rates are set by credit card networks like Visa, Mastercard, and Discover, and dictate the fees that merchants have to pay for processing credit card transactions. Interchange rates vary based on factors like the type of card used, the transaction volume, and the industry of the business.

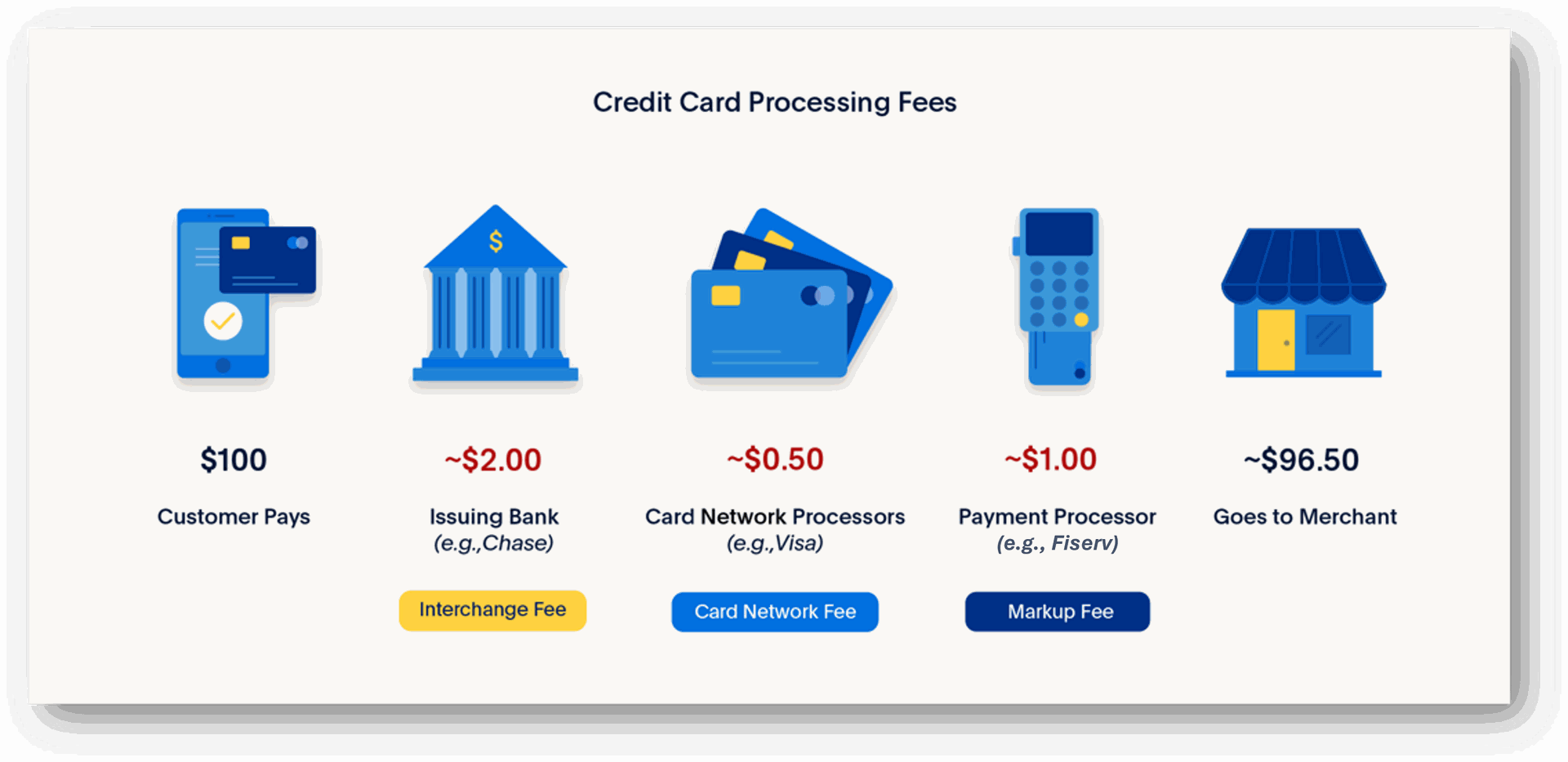

Credit card interchange rates, also known as interchange fees or swipe fees, are transaction fees that merchants pay to banks when customers use a credit or debit card to make a purchase. These fees are set by card networks like Visa, Mastercard, and Discover, and are usually a percentage of the transaction amount plus a fixed fee. The average rate is around 2% of the purchase amount, but can vary significantly depending on several factors:

- Type of cardRewards cards, business cards, and premium cards typically have higher interchange fees than standard debit or credit cards.

- Transaction typeThe rate could vary for purchases made at a restaurant versus ones made through an airline, for example.

- Whether the purchase was made online or in person.

The rate is typically lower for point-of-sale transactions made in person than card-not-present transactions, like when you're shopping online.

Working with an expert in payment processing, like IMC Payment Solutions, can help your business navigate the complex world of credit card interchange rates. IMC Payment Solutions has a team of professionals who are well-versed in the intricacies of interchange rates and can provide you with the guidance you need to optimize your payment processing strategy.

One of the key benefits of understanding credit card interchange rates is that they can be lower than tiered pricing. Tiered pricing is a common pricing model used by many payment processors, where transactions are categorized into different tiers based on criteria like card type and transaction volume. This can result in businesses paying higher fees than necessary.

By working with a knowledgeable payment processor like IMC Payment Solutions, you can take advantage of lower interchange rates and potentially save your business money in the long run. IMC Payment Solutions offers transparent pricing models that prioritize your bottom line, so you can focus on growing your business without worrying about excessive fees.

In conclusion, credit card interchange rates are a critical aspect of accepting credit card payments for businesses. Working with a knowledgeable payment processor like IMC Payment Solutions can help you navigate the complexities of interchange rates and optimize your payment processing strategy.

By understanding how interchange rates work and finding ways to lower them, you can save your business money and streamline your payment processing operations.

Don't let interchange rates be a mystery – take control of your payment processing today with the help of IMC Payment Solutions.